illinois estate tax return due date

The estate or trust will have a separate tax identification number from that of the decedent and is considered a distinct taxable entity. Your Illinois filing due date is the same as your federal filing due date.

Illinois Estate Tax Faqs Federal Tax Exemptions For Estates Estate And Probate Legal Group

Payments of estate taxes will no longer be accepted by the County Treasurer of the county in which the decedent died a resident.

. Estate taxes should be paid within nine months after the death of the loved one. 97-0732 any and all payments of Illinois estate tax interest and penalties must now be made payable to the Illinois State Treasurer. Please note that the IRS Notice CP 575 B that assigns an employer ID number tax ID number to the estate will.

The option to file Form IL-1040 Illinois Individual Income Tax Return without having a MyTax Illinois account non-login option is no longer available. The original due date to file and pay Illinois individual income tax for calendar year filers is April 18 2022. The State of Illinois levies a separate estate tax on estates of Illinois resident decedents and estate of non-residents owning real property in Illinois.

If you would like to. Taxpayers affected by the severe weather and tornadoes beginning December 10 2021 have been provided with an extension of time to file their 2021 IL-1040 until May 16 2022. If the value of an estates assets combined with all taxable gifts made during the decedents lifetime is over 4 million and no tax deductions apply the estates executor.

A Federal Estate Tax Return or any other form containing the same information is attached. For more information see press release. Adjusted Taxable Estate At Least But Less Than Credit.

Illinois Tentative Taxable Estate. Up to 25 cash back If the estate might owe Illinois estate tax your executor will have to file an Illinois estate tax return within nine months after death. However it is only applied on estates worth more than 4 million.

So if you live in the Prairie State and are thinking about estate planning you should learn about this all. Filing a Tax Return. We grant an automatic six-month extension of.

State Death Tax Credit Table. In general Form IL-1041 Fiduciary Income and Replacement Tax Return is due on or before the 15th day of the 4th month following the. In general Form IL-1041 is due on or before the 15th day of the 4th month following the close of the tax year.

The 2017 federal tax raise estate taxes from 55 million for individuals and 11 million for married couples to 11 million for individuals and 22 million for married couples. What is the due date of Form IL-1041. Federal estate tax means the tax due to the United States with respect to a.

When filing estate taxes IRS Form 706 is due within nine months of a decedents date of death but filing Form 4768 automatically grants a six-month extension. The due date for calendar year filers is April 18 2022. What about Illinois Estate Tax.

Effective July 1 2012 as a result of the enactment of SB 3802 as PA. Illinois Tentative Taxable Estate. 97-0732 any and all payments of Illinois estate tax interest and penalties must now be made payable to the Illinois State Treasurer.

This extension request should be filed within 9 months of date of death. The due date of the estate tax return is nine months after the decedents date of death. Illinois Compiled Statutes Table of Contents.

On Saturday June 30 2012 Governor Pat Quinn signed into law a 337 billion budget plan that makes changes to the states spending priorities while reducing its. Form 1041 is the form used for federal. Effective July 1 2012 as a result of the enactment of SB 3802 as PA.

Only about one in twelve estate income tax returns are due on April 15. Due to closures related to COVID-19 the Attorney Generals Office will be operating with reduced staff. Preparing the returns is usually a.

Plus Adjusted Taxable Gifts. What about Illinois Estate Tax. A fillable form for making payment of the.

35 ILCS 4052 from Ch. Estates valued under 4 million do not need to file estate taxes. Under current law in 2013 the amount.

The due date for calendar year filers is April 15 of the year following the tax year of your return unless April 15 falls on a weekend or holiday. 2013-2021 Decedents Estate Tax Calculator.

Estate And Trust Tax Id Numbers Faq On The Ein From The Irs Law Offices Of Jeffrey R Gottlieb Llc

Exploring The Estate Tax Part 2 Journal Of Accountancy

Federal Estate Tax Facts You Should Know So You Can Pass As Much Tax Free Money As Possible To Loved Ones Karp Law Firm

Irrevocable Trusts What Beneficiaries Need To Know To Optimize Their Resources J P Morgan Private Bank

How Long Does Probate Take In Illinois Estate And Probate Legal Group Estate And Probate Legal Group

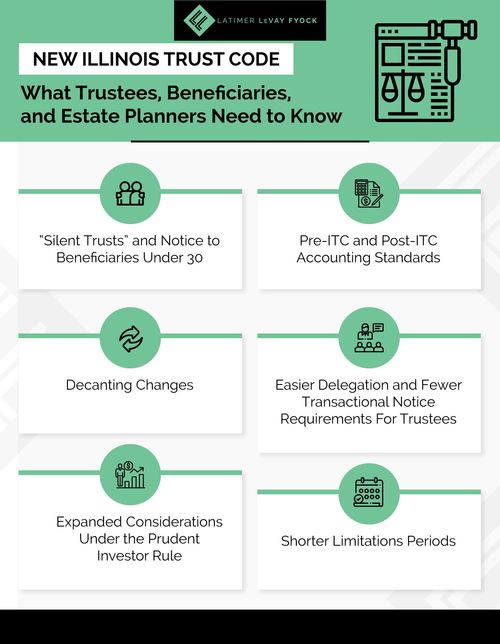

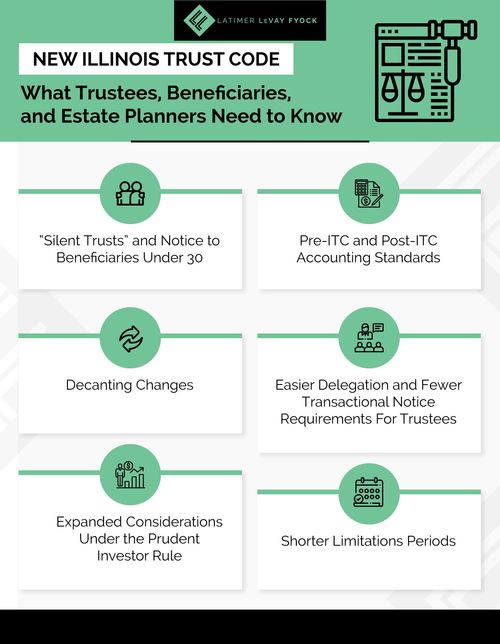

The New Illinois Trust Code What Trustees Beneficiaries And Estate Planners Need To Know Latimer Levay Fyock Website Website Of Llf Legal Based Out Of Chicago

Illinois Probate What Are Letters Of Office Law Offices Of Jeffrey R Gottlieb Llc

Did You Know Certain Tax Return Due Dates Changed This Year Preservation Family Wealth Protection Planning

Free Illinois Revocable Living Trust Form Pdf Word Eforms

Michael W Frerichs Illinois State Treasurer Secure Choice

New York S Death Tax The Case For Killing It Empire Center For Public Policy

How To Calculate Estate Taxes Upon Death In Illinois Gardi Haught Fischer Bhosale Ltd

Illinois Estate Planning Will Drafting And Estate Administration Forms With Practice Commentary Lexisnexis Store

Illinois Estate Tax Faqs Federal Tax Exemptions For Estates Estate And Probate Legal Group

Prepare And E File Your 2021 2022 Illinois And Irs Income Tax Return